Executive Summary

The intralogistics landscape is changing at pace: warehouse throughput demands, around‑the‑clock operations, and corporate sustainability targets are forcing fleet operators to rethink power systems. This white paper explains the technological and commercial forces reshaping forklift energy, summarizes the most impactful innovations, and presents RICHYE’s practical solution architecture for fleet transition. It includes actionable guidance for procurement, deployment, and lifecycle management, plus two charts that illustrate market momentum and a modeled Total Cost of Ownership (TCO) comparison.

Market snapshot and opportunity

Global demand for forklift battery systems is expanding rapidly as logistics operators electrify fleets and redesign facilities for higher utilization. This growth is driven by sustained e‑commerce volumes, multi‑shift operations, and stricter corporate and regulatory decarbonization commitments. Facilities that move to optimized battery platforms unlock higher vehicle utilization, lower maintenance overhead, and simplified energy management — making batteries a strategic investment rather than a simple consumable.

Key implication: companies that proactively modernize battery infrastructure will gain material advantages in uptime, safety, and operating economics.

Technology trends reshaping forklift power

LFP chemistry as the industrial standard

Lithium iron phosphate (LiFePO₄, or LFP) offers a compelling balance of thermal stability, cycle life, and lifecycle cost for heavy intralogistics use. Compared with traditional lead‑acid systems, LFP supports deeper usable discharge, faster and more frequent opportunity charging, and reduced facility complexity (no watering rooms or acid handling).

Integrated Battery Management Systems (BMS)

Battery packs are now vehicle systems: modern BMS units manage cell balancing, thermal control, state‑of‑charge/state‑of‑health estimation, and safety interlocks. When connected to fleet telematics, BMS data enables condition‑based maintenance and remote diagnostics that materially increase fleet availability.

Opportunity charging and intelligent charging architecture

Intelligent chargers and fast‑charging strategies allow operators to reduce spare battery counts by charging batteries during short downtime windows. Chargers that negotiate with the BMS to apply tailored charge profiles extend calendar life and reduce thermal stress.

Digital services and predictive maintenance

Telematics and cloud analytics turn maintenance into a proactive, data‑driven practice. Predictive analytics extend battery life, optimize charge scheduling, and provide verifiable usage records that can be folded into warranty and BaaS arrangements.

Circularity and responsible end‑of‑life management

As lithium adoption rises, circular economy practices — design for disassembly, refurbishment, and certified recycling — become essential for regulatory compliance and corporate ESG reporting.

Practical economics: beyond upfront cost

While lithium solutions typically require higher initial investment, the total economics often favor modern chemistries in multi‑shift and high‑utilization environments. The key cost levers are:

-

Energy efficiency: higher usable energy fraction reduces effective energy cost per shift.

-

Maintenance savings: elimination of watering, acid handling, and many service touchpoints reduces labor and safety incidents.

-

Reduced downtime: faster charging and improved reliability reduce the number of spare units required.

-

Lifecycle extensions: longer cycle life and predictable degradation profiles enable cleaner replacement planning.

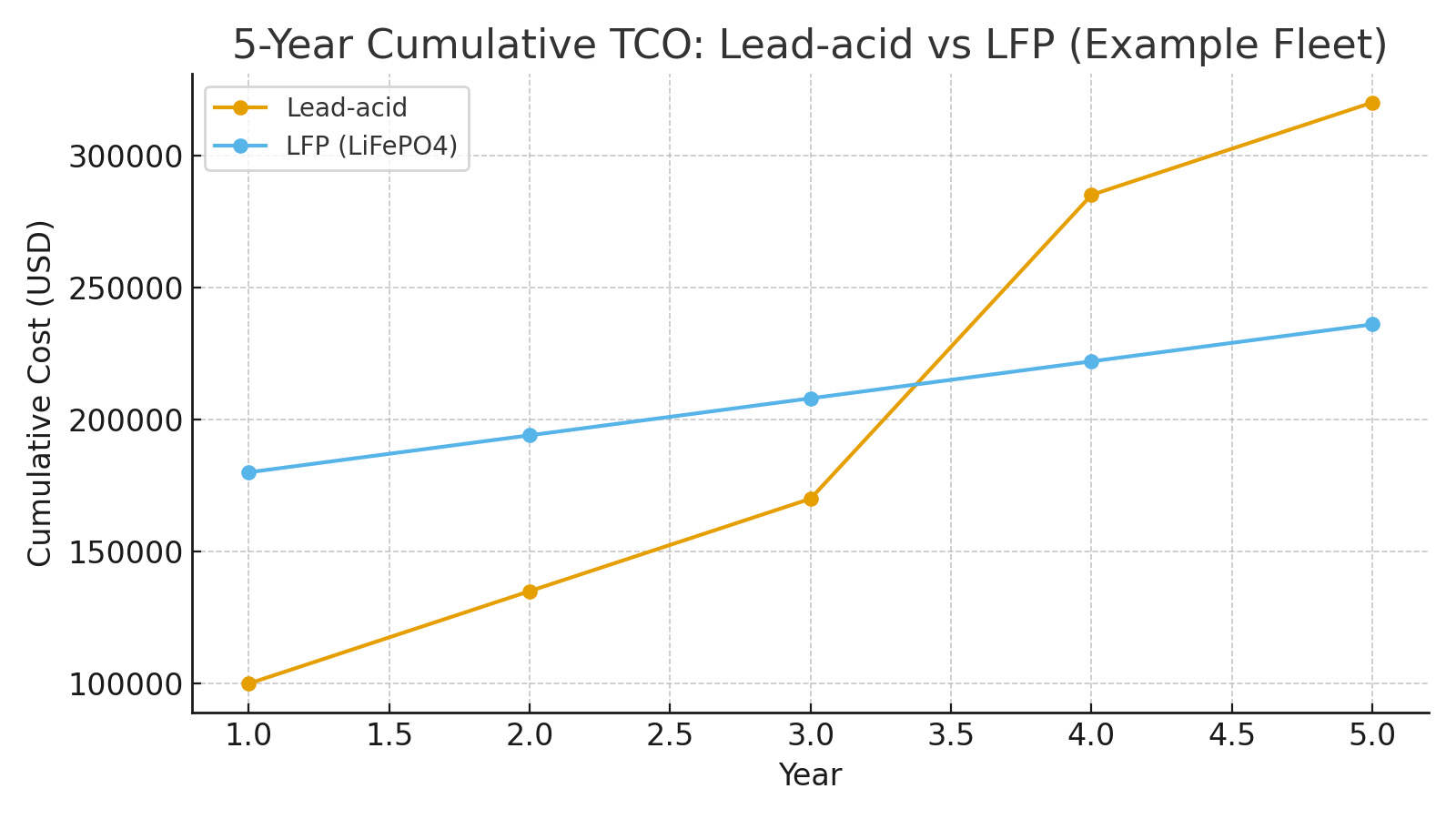

Above presents a modeled 5‑year cumulative TCO comparison between a representative lead‑acid deployment and a LiFePO₄ solution. The modeled example highlights how higher upfront cost can be offset by lower maintenance, replacement avoidance, and improved utilization.

Above presents a modeled 5‑year cumulative TCO comparison between a representative lead‑acid deployment and a LiFePO₄ solution. The modeled example highlights how higher upfront cost can be offset by lower maintenance, replacement avoidance, and improved utilization.

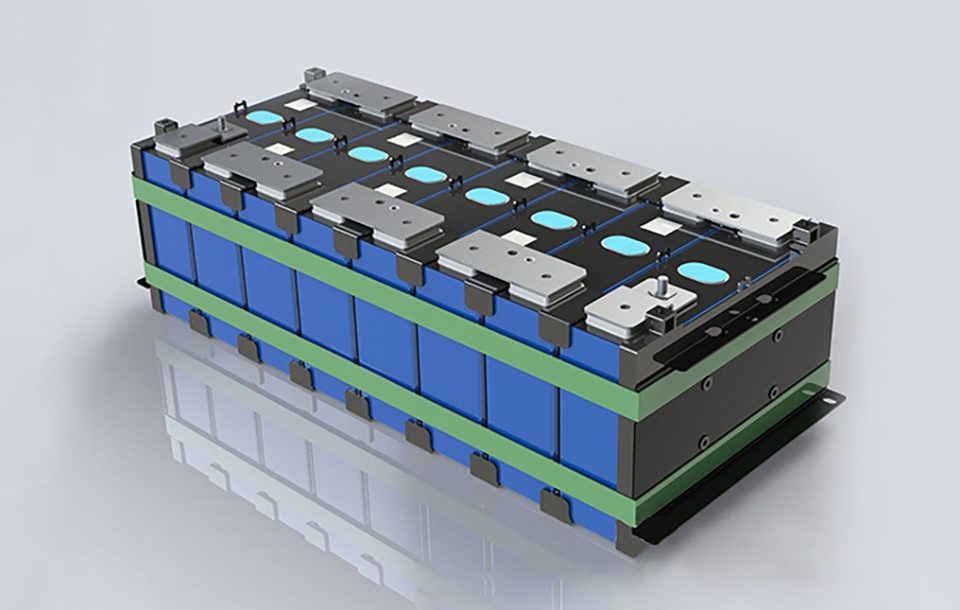

RICHYE solution architecture

RICHYE’s offering is engineered to translate technical advantages into operational outcomes. The solution bundles modular LFP battery packs, integrated BMS, a charging ecosystem, telematics integration, and end‑of‑life services.

Product design: modular LFP packs sized for common forklift footprints, with rugged enclosures and standardized mechanical interfaces to simplify retrofits and OEM integration.

Smart BMS: CAN‑bus enabled management that provides cell balancing, thermal logic, and open diagnostic endpoints for telematics platforms.

Charging ecosystem: intelligent, grid‑aware chargers that support opportunity charging and integrate into building energy management systems to reduce demand charges.

Commercial models: flexible procurement including direct sale, leasing, and Battery‑as‑a‑Service (BaaS) models to lower acquisition barriers and match costs to outcomes.

Lifecycle services: certified refurbishment and recycling pathways that minimize environmental impact and provide transparency for ESG reporting.

Deployment & integration checklist

RICHYE recommends the following stepwise approach for safe, fast, and value‑driven adoption:

-

Duty‑cycle analysis: collect shift patterns, typical depth‑of‑discharge, and duty profiles.

-

TCO modeling: include energy, maintenance, downtime, replacement cadence, and incentives.

-

Electrical readiness: assess distribution capacity, charger siting, and demand‑management needs.

-

Telematics integration: define required data endpoints and API access for fleet systems.

-

Pilot deployment: validate ROI on a subset of the fleet and refine charge scheduling.

-

Training & safety: implement procedures for lithium battery handling and emergency response.

-

End‑of‑life plan: contract for refurbishment or certified recycling.

RICHYE supports customers across the entire lifecycle — from pilot and commissioning to fleetwide rollout and end‑of‑life services.

Business models that accelerate adoption

RICHYE offers tailored commercial structures to match operator risk appetite and capital constraints:

-

Direct sale for operators who prefer asset ownership and full depreciation schedule control.

-

Leasing to spread capital cost over predictable monthly payments.

-

Battery‑as‑a‑Service (BaaS) where RICHYE retains ownership of the battery assets and customers pay for delivered energy and uptime guarantees.

Outcome‑based contracts (uptime SLAs, kWh‑delivered pricing) align incentives and make high‑utilization conversions financially predictable.

Key takeaways

-

Batteries are now strategic assets that materially affect uptime, safety, and TCO.

-

LiFePO₄ chemistry combined with integrated BMS and telematics is emerging as the industrial standard for intralogistics.

-

Fast/opportunity charging and digital services unlock utilization gains that often offset higher initial investment.

-

Responsible end‑of‑life management is critical for supply security and ESG compliance.

-

RICHYE’s integrated product, services, and commercial offering simplifies the transition and mitigates operational risk.

About RICHYE

RICHYE designs and delivers industrial energy solutions that prioritize reliability, safety, and circularity. Our forklift battery systems combine rugged LFP chemistry, intelligent battery management, and lifecycle services to help logistics operators maximize uptime while minimizing environmental and operational risk.